ri tax rates by city

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Rhode Island Taxable Income Rate.

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

Early Voting is available at City Hall during regular business hours 830 am.

. The latest sales tax rates for cities in Rhode Island RI state. 2020 rates included for use while preparing your income tax deduction. Additional requirements are found on the.

East Providence City Hall 145 Taunton. Welcome to the city of Central Falls Rhode Island. The formula to calculate Rhode Island Property Taxes is Assessed Value x Property Tax Rate1000 Rhode Island Property Tax.

The tax rates for the 2022-2023 fiscal year are as follows. Early Voting is available at City Hall during regular business hours 830 am. The latest sales tax rates for cities in Rhode Island RI state.

Assessment Form 2022 Tax Rates. Pawtucket City Hall Tax Assessors Office - Room 109 137 Roosevelt Avenue Pawtucket RI 02860. Take the Assessed Value of the property then multiply.

1851 for every 1000. About Toggle child menu. City ClerkRecords.

41 rows West Warwick taxes real property at four distinct rates. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. By law you are required to change.

City of East Providence Rhode Island. FY2023 starts July 1 2022 and ends June 30 2023. RI Our Current Tax Rate View Newports current Tax Rate on real.

2022 List of Rhode Island Local Sales Tax Rates. 2018 Tax Rates 392 KB Tax. 1 to 5 unit family dwelling.

Lowest sales tax 7 Highest sales tax 7 Rhode Island Sales Tax. The tax rates for the 2022-2023 fiscal year are as follows. City of Woonsocket 169 Main Street Woonsocket RI 02895 401 762-6400.

FY2023 Tax Rates for Warwick Rhode Island. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one. The current tax rates and exemptions for real estate motor vehicle and tangible property.

Tax Rates Tax Rates for the 2022-2023 Tax Year. Rhode Island also has a 700 percent corporate income tax rate. Tax Rates Exemptions.

2022 Tax Rates. The latest sales tax rates for cities in Rhode Island RI state. 3243 - commercial I and II industrial commind.

Senior Citizens with total household income not exceeding 29080 single or 38027 couple may be eligible for a 20 reduction in their taxes. The table below shows the income tax rates in Rhode Island for all filing statuses. - 430 pm Monday.

Rhode Island Towns with the Highest Property Tax Rates. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. 2022 Tax Rates assessed 12312021.

Rhode Island has state sales. FY2023 Tax Rates for Warwick Rhode Island. Rates include state county and city taxes.

Average Sales Tax With Local. There are no local city or county sales taxes so that rate is the same. The sales tax rate in Rhode Island is 7.

Rhode Island has a. Detailed Rhode Island state income tax rates and brackets are available on. State of Rhode Island Division of Municipal Finance Department of Revenue.

2989 - two to five family residences. The tax rates for the 2022-2023 fiscal year are as follows. - 430 pm Monday - Friday through Tuesday.

Community Residents Visitors. There was no increase in our tax rates from last year the tax rates remain.

Seven Things To Know About The R I House Finance Budget The Boston Globe

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

Golocalprov The Highest Car Taxes In Ri For 2013

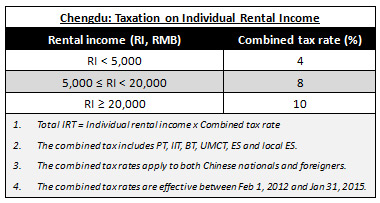

Taxation On Real Estate Rental Income In China China Briefing News

Sales Taxes In The United States Wikipedia

Charlestown Commission Recommends Budget With Reduced Spending Level Tax Rate Charlestown Thewesterlysun Com

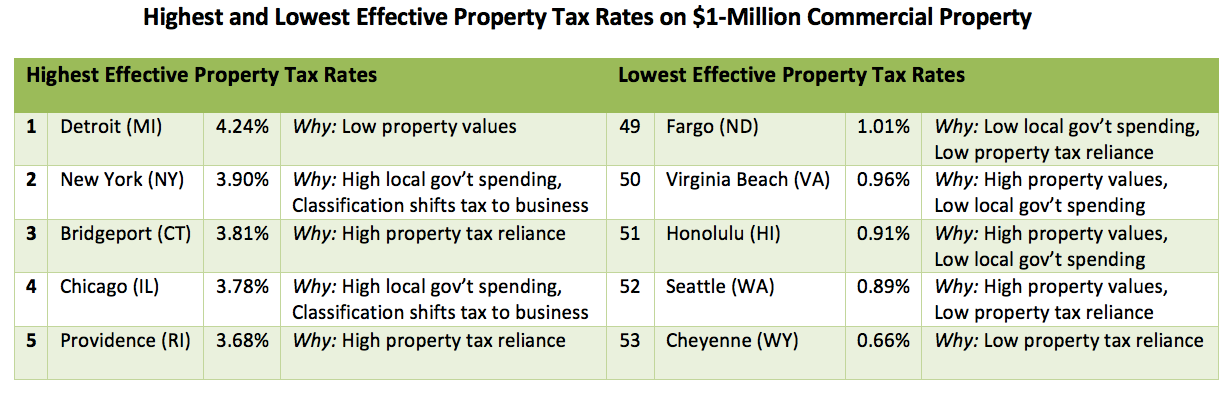

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy

Property Tax Calculator Estimator For Real Estate And Homes

Commercial Tax Rate Freeze Wouldn T Help Businesses

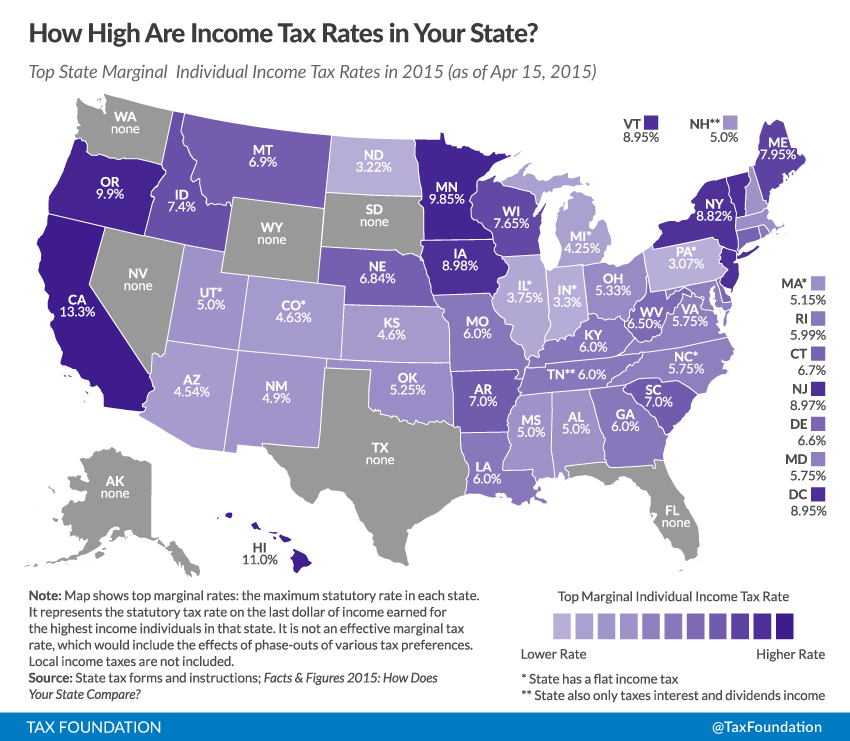

State Individual Income Tax Rates And Brackets Tax Foundation

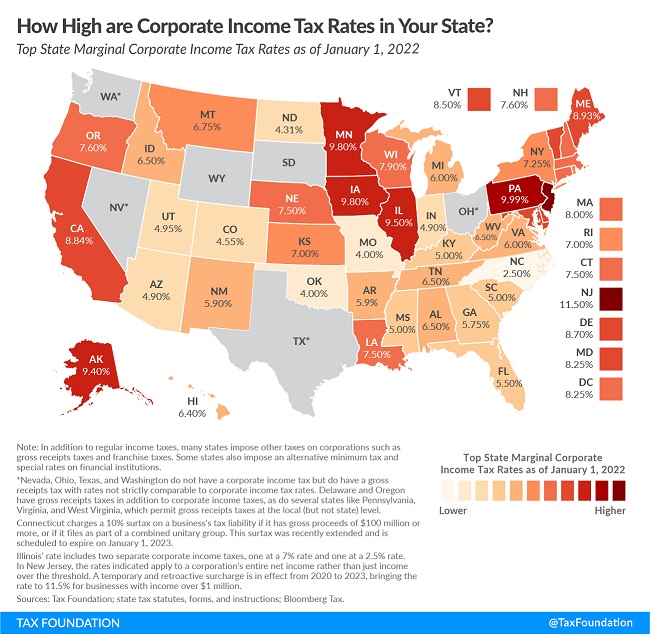

Tax Foundation R I Corporate Tax Rate Ranks Among Middle Of States

Rhode Island S Funding Formula After Ten Years Education Finance In The Ocean State Rhode Island Public Expenditure Council

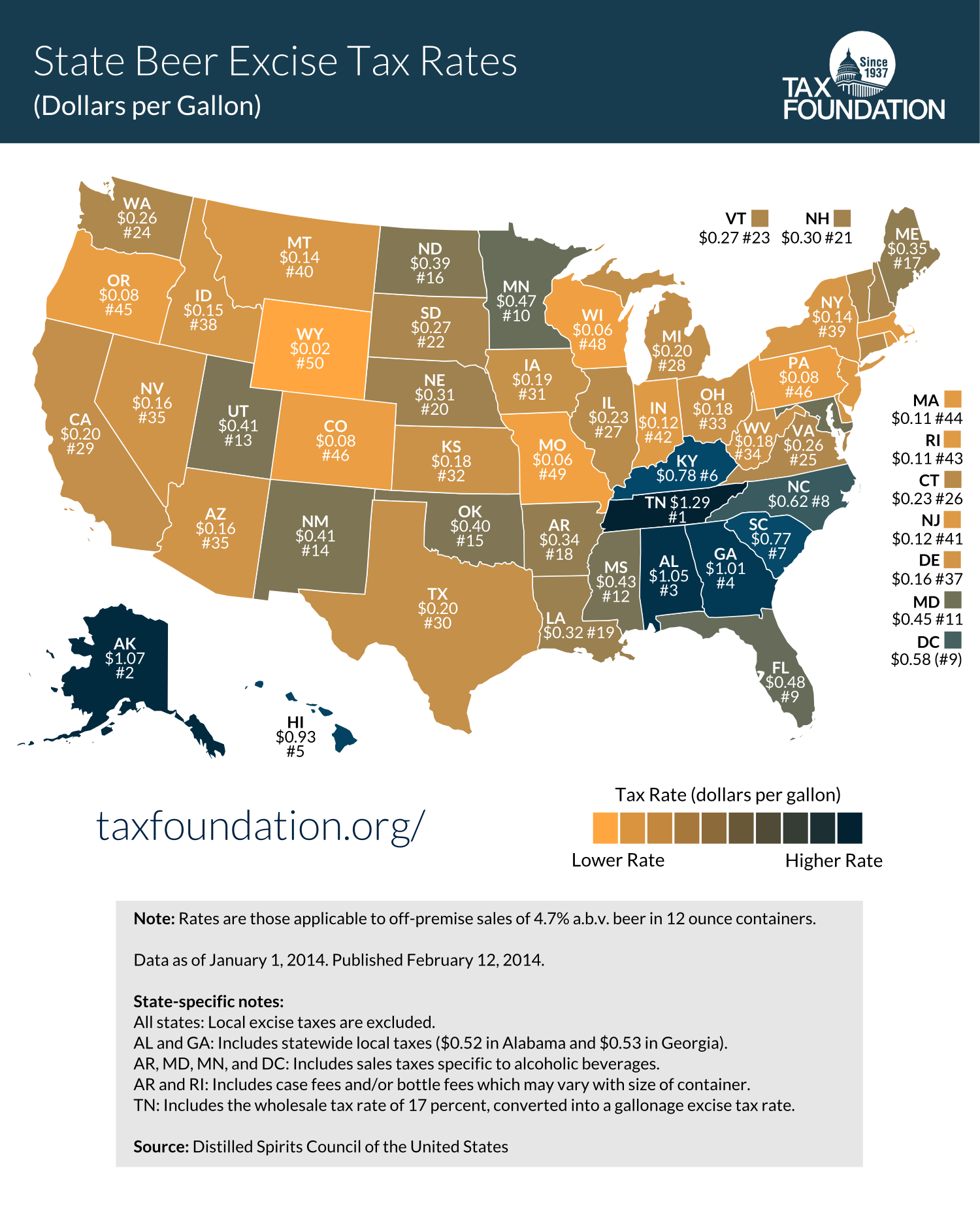

Map Beer Excise Tax Rates By State 2014 Tax Foundation

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Sales Tax On Grocery Items Taxjar